Rare Earth Recycling

Rare earth recycling is in progress. Due to their chemical or physical properties, these metals are necessary for many industries. They play a key role in green electronics and equipment. The term rare earths refers to a group of seventeen metals (scandium, yttrium and the fifteen lanthanides) used widely in the new technologies (mobile phones, wind turbines, LCD screens, batteries). Used in small amounts, these metals make it possible to enhance the physical or magnetic properties of other materials.

Since 2008, recycling also had a geopolitical role recognized by the European Union, specifically ensuring European supply with critical materials (i.e., imported, irreplaceable materials, of great economic importance, but which are not ‘strategic’ from a military point of view).

Rare earth market – USD 9 billion per year

The rare earth market remains small globally: it is estimated at approximately USD 9 billion per year. Despite the name, rare earths are not particularly rare from a geological point of view. Rare earths are generally extracted in polymetallic mines. 85% of the global rare earth production comes today from China, which has implemented since 2010 an export quota policy that has greatly destabilized the market.

Rare earths – an ideal candidate for recycling

Very difficult to replace, essential to the new informational technologies and energy transition, subject to geopolitical pressure, rare earths are classified by the European Union as some of the most critical materials. As such, they are an ideal candidate for recycling.

In the case of rare earths, there are great uncertainties as to the actual contribution this recycling can bring.

First of all, it is very difficult to assess the rare earth quantities contained in the existing products. There are studies aimed to determine the quantities of waste produced on European soil and, therefore, assess the quantities of potentially recyclable materials.

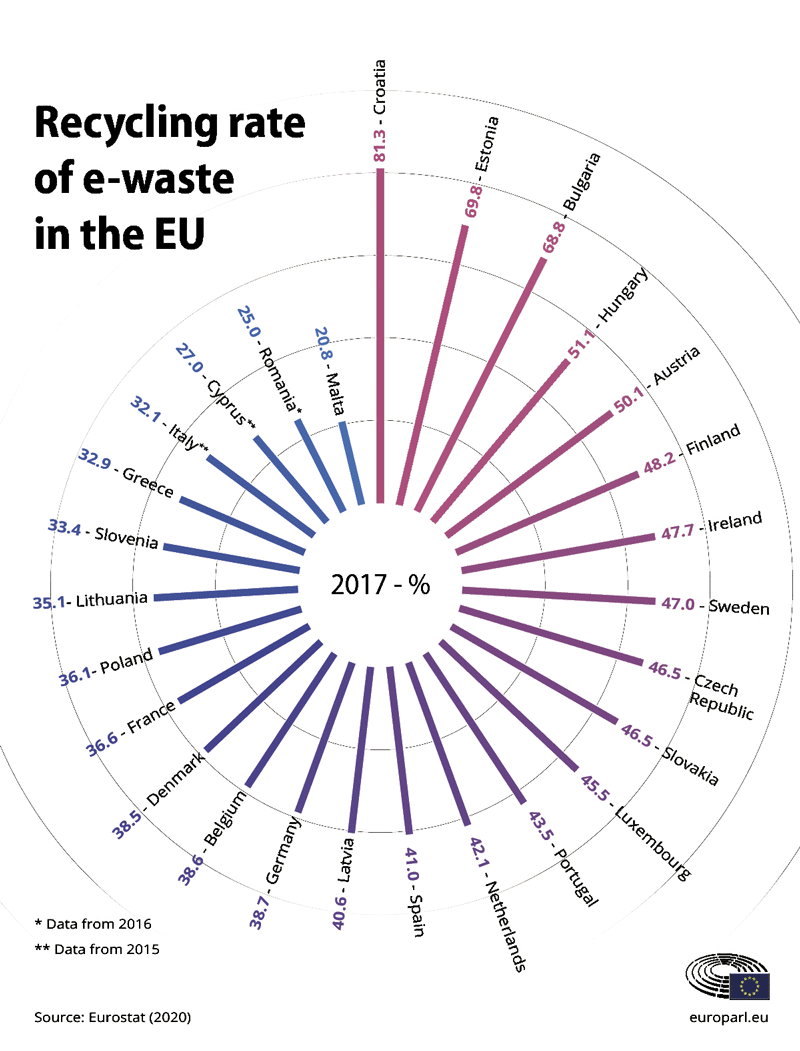

Methods to quantify electrical and electronic waste

There are several methods to quantify electrical and electronic waste, which is the main source of secondary rare earths.

A first method (consumption and use method) estimates the average equipment of households with electrical and electronic devices and the predictable lifespan of the devices to deduct the potential quantity of electrical and electronic waste (WEEE).

This method is used, for example, by the Netherlands. A second method uses the production and sales figures for a certain geographic region. This method is used by the German Electrical and Electronic Manufacturers’ Association.

Another method is ‘saturation’, which shows that, as European households are already saturated with electrical and electronic equipment, each new sale corresponds to an old object that has been thrown away. This method is used by the Swiss Environment Agency.

As it relies on estimates regarding the lifecycle of objects, these methods involve significant uncertainties regarding the purchased quantities and in particular the lifetime of objects.

Assumptions on the lifetime of objects must take consumer behaviour into consideration. A Nokia survey on the future of mobile phones shows that, even in the developed countries, only 12% of the mobile phones are recycled after use. These uncertainties make any international comparison difficult and explain the discrepancies, sometimes significant, in the estimates of waste amounts. According to manufacturers, the quantities of rare earths vary significantly from one product to the next, while they have the same functional properties. Also, there is no certainty on the further use of rare earths in certain product lines: some manufacturers, faced with the volatility of the rare earth market, preferred not to use them in their new product lines. For example, there are car manufacturers that do not use rare earths in the manufacture of their electric vehicles.

Bacteria, algae, or fungi can absorb rare earths

Microorganisms such as bacteria, algae, or fungi can absorb rare earths into their cells and cause them to ferment.

The European project REEgain, funded with EUR 1 million by the European Regional Development Fund (ERDF) by the end of June 2022, tried to provide an answer to this problem through a biological phenomenon: under certain conditions, microorganisms such as bacteria, algae or fungi can absorb rare earths into their cells and cause them to ferment. Therefore, the REEgain project aims to demonstrate the feasibility of the process.

Strong permanent magnets are essential, e.g., in future transport, wind energy and water management applications. High performance magnets require the use of rare earth elements, which have been exposed to dramatically price variations the past years. Therefore, there is a need to focus research on improving the magnet production and recycling technologies with reduced dependency of scarce elements, without compromising their functional performance.

Magnets with better temperature characteristics, hard permanent magnets with a high magnetization and high coercivity must be investigated. Also issues such as lifetime assessment and new coating strategies have to be considered.

The REEgain consortium addresses these aspects by a joint effort on research, innovation, and technology development.

So far, the feasibility seems very good. Specialists say they are trying to find what organisms absorb rare earths and in what amount. Experts also claim that the best candidates absorb approximately 75-80% rare earths in a solution.

In order to start the fermentation process, rare earths must first exist in the electronic waste in the form of powder which are then dissolved in nitric acid. Nitric acid is not harmless to the environment, but because it serves as a source of nitrogen for the organisms concerned and is used only in very small amounts, there is nothing left at the end of the process. The microorganism and a nutrient solution are then added to the dissolved powder. By adjusting the process parameters, such as temperature, pH, or oxygen concentration in the nutrient medium, it is then possible to control the growth of organisms. The duration of the process depends on the organism used: with bacteria, fermentation lasts about 72 hours, single-celled fungi need three to five days, algae two to three weeks. Rare earths can then be removed from microorganisms and only microorganisms and biodegradable liquid remain from the fermentation at the end of the process.

To further optimize the process, researchers at IMC Krems are also studying so-called co-cultures: this involves combining two different types of organisms that behave like symbionts. One of the goals is to grow a photoautotrophic organism – which needs only light and carbon dioxide to grow – with a heterotrophic organism – which feeds on carbon. This is because photoautotrophic organisms such as algae can produce substances from carbon dioxide in the air that serve as a source of food for heterotrophic organisms, such as bacteria. Also, different microorganisms absorb rare earths differently. It will take some time before the process can be used on a commercial scale. But the basic feasibility of the process now seems beyond doubt.

The largest rare earth producing countries

Contrary to what they name suggests, rare metals are present everywhere on earth. But only some countries have specialized in their extraction.

It is the case of China, which accounts for 95% of the global rare earth production and operates tungsten, graphite, gallium, indium, and germanium mines.

Kazakhstan produces chrome, cobalt comes from the Democratic Republic of Congo (DRC) and niobium from Brazil.

In terms of lithium, an abundant metal, but also essential to digital transition, the main mines are in Australia, Chile, Bolivia and Argentina.

Ecologic and social consequences of rare metals

The exploitation of rare metals is extremely difficult from an industrial point of view. The ore must be extracted from tens of kilograms of rock, purified and transformed with chemicals, which are often disposed of in nature.

In China, for example, damage to health caused by the extraction of rare metals is huge. Wastewater, sometimes filled with radioactive waste, is dumped in nature, and pollutes waterways and groundwater.

Cobalt mining conditions in DR Congo are equally deplorable from an environmental and social point of view. To obtain 1 kilogram of lutetium it is necessary to extract 1200 tons of rock. In the same way, for the latest generations of offshore wind turbines, at least 600 kilograms of neodymium are needed.

Most often, the technique of recovering rare metals is to strip the earth to reach the ores.

Once the excavation has been carried out, the rocks must be crushed into a fine powder and the elements separated. Most often this operation is done with strong acids or other chemicals that seep into the soil to the waterways and pollute groundwater. Then comes the refining operation, which produces radioactively charged metal dust.

Cancer rates among people living near open-pit rare earth mines are extremely high.

Rare earths, very polluting

Rare earths have been used on a large scale since the 1950s and are used for all sorts of things, of which most cannot enjoy a green label. For example, oil refineries are some of the main users of rare earth elements, as wells as television and computer screen manufacturers and the entire metallurgical sector.

Green technologies, including wind turbines and solar collectors, need them, as well as the weapon manufacturers and constructors of large SUVs. Demand for some of the 17 minerals that make up the rare earth family is growing rapidly. The total market is estimated at USD 9 billion, which is quite modest, but it is expected to double by 2030.

The mining activity of ionic rare earth extraction results in the destruction of the vegetation cover of the site, as well as the stripping of the vegetal soil layer in order to reach the ore and to extract rare earth oxides. Once the extraction site has been abandoned, no natural vegetation remains, but only excavations and waste.

The extraction of one ton of rare earth oxides produces 1,300 to 1,600 m3 of excavation waste

If measures to protect these large amounts of waste are not implemented, torrential rains can cause mixtures of mud and rocks on agricultural land, increase the flow of rivers, reservoirs and pollute water resources.

Studies show that soil erosion in landfills is very high, reaching 41,800 T/m2, which is 50 times higher than the initial vegetation cover. Proper re-vegetation of the site is necessary to stop these harmful effects on the environment.

40% to 75% of Europe’s clean energy metal needs could be met through recycling by 2050

The European Union is likely to suffer severe shortfalls in lithium, rare earths and other metals needed to cut carbon emissions, but recycling could help plug the gap from 2040, according to a study commissioned by industry group Eurometaux released in April 2022. The issue has become even more critical due to the EU’s recent efforts to become less dependent on Russia for energy.

“The global energy transition is progressing faster than the mining project pipeline, with copper, cobalt, lithium, nickel, and rare earths all at risk of a disruptive demand pull between now and 2035,” said the study by Belgium’s KU Leuven University.

The EU’s pledge to cut net greenhouse gas emissions to zero by 2050 will require large amounts of metals and minerals to roll out electric vehicles and wind turbines. The study said the bloc will need 35 times more lithium and seven to 26 times more rare earths by 2050, used in EV batteries and motors respectively.

Coal-powered Chinese and Indonesian metal production will dominate global refining capacity growth for battery metals and rare earths, while Europe also relies on Russia for aluminium, nickel and copper, the study said. Recycling will help ease shortages, but only from about 2040, when there is enough material from scrapped vehicles and other equipment such as wind turbines, it said.

By 2050, 40% to 75% of Europe’s clean energy metal needs could be met through recycling if Europe invests heavily now and fixes bottlenecks, the study underlined.

The European Association of Metal Producers (Eurometaux) is an umbrella association of non-ferrous metals producers and recyclers in Europe.

Green rare earth recycling going commercial in the US

An innovative method of recycling rare earth elements from electronic waste has gone commercial. A team of researchers from the Critical Materials Institute (CMI), a U.S. Department of Energy Innovation Hub led by the Ames Laboratory, developed a novel way to extract rare earth elements (rare earths) from the high-powered magnets in electronic waste (e-waste).

Rare earths are essential ingredients in the magnets that power many technologies people rely on today, such as cell phones, computers, electric vehicles, and wind turbines. Since 1990 supplies of these elements have become limited and recycling them is one way to address their limited availability.

Ikenna Nlebedim, the lead researcher on the recycling project, explained that big companies shred items like computer hard drives to protect the information on them. Once the drives are shredded, recycling becomes more complex because other recycling methods depend on separating the magnets from other materials. The CMI’s recycling process is designed to extract the rare earths directly from shredded e-waste.

The Critical Materials Institute is a Department of Energy Innovation Hub led by the U.S. Department of Energy’s Ames Laboratory and supported by the Office of Energy Efficiency and Renewable Energy’s Advanced Manufacturing Office, working to decarbonize industry and increase the competitiveness of the U.S. manufacturing and clean energy sectors through process innovations, collaborations, research and development, and technical assistance and workforce training. CMI seeks ways to eliminate and reduce reliance on rare earth metals and other materials critical to the success of clean energy technologies.

Global rare earth metals recycling market

According to ‘Global Rare Earth Metals Recycling Market Report 2022-2026: Recycling of Rare Earth Metals Leads to Steady Material Sourcing & Net-Zero Goals by 2050 to Promote Recycling of Rare Earth Metals’, the global rare earth metals recycling market is estimated to be USD 248 million in 2021 and is projected to reach USD 422 million by 2026, at a CAGR of 11.2% from 2021 to 2026.

Rare earth metals are considered key elements in developing technologies in the communications, electronics, automotive, and military weapon sectors. The demand for these elements is expected to increase in the near future as these are key components in emerging applications, such as green technology and electric and hybrid vehicles.

Asia Pacific has witnessed tremendous growth in the past few years, driven by the growing population, favourable investment policies, growing economies, and government initiatives directed at promoting electronics and automobile industries in the region. The region is the largest consumer of rare earth materials due to rapidly increasing demand in China, which accounts for the maximum consumption of rare earth metals globally.

The rare earth metals recycling market comprises major solution providers, Solvay SA (Belgium), Hitachi Metals, Ltd. (Japan), Umicore (Belgium), Osram Licht AG (Germany), Energy Fuels, Inc. (US), Global Tungsten & Powders Corp. (US), and REEcycle Inc. (US) among others.