World Markets: Commodity Prices Going Crazy

Since Ukraine’s invasion by Russia, on February 24, the commodity prices have increased at record speeds. The shock is felt everywhere, starting with electricity and gas bills.

Earth’s resources should meet the needs of a planet of over 7 billion inhabitants. In the past, the Dutch traded in sugar and nutmeg, and the Assyrians paid eight times the price of gold for the same amount of iron. Mankind competed in the past for bronze, pepper, or whale oil, and today it does so for nickel or gas.

Ukraine’s invasion creates new battles. As Russian soil is a huge provider of metals of all types, but also of food products, disrupting trade inflames the markets. But even when the war ends, commodity prices will stay under some pressure for a long time. And that’s because of two major reasons: one economic and the other political. In order to fulfill the target of carbon neutrality in 2050, the International Energy Agency (IEA) foresees that renewable energy will account, by that time, for 70% of production, compared to 9% at the moment. Power plants and vehicles will no longer consume oil, but cobalt, nickel, lithium, which are essential metals for their manufacture. For the IEA the demand is expected to increase seven-fold by 2030.

Commodities and agricultural goods, the last stronghold of capitalism?

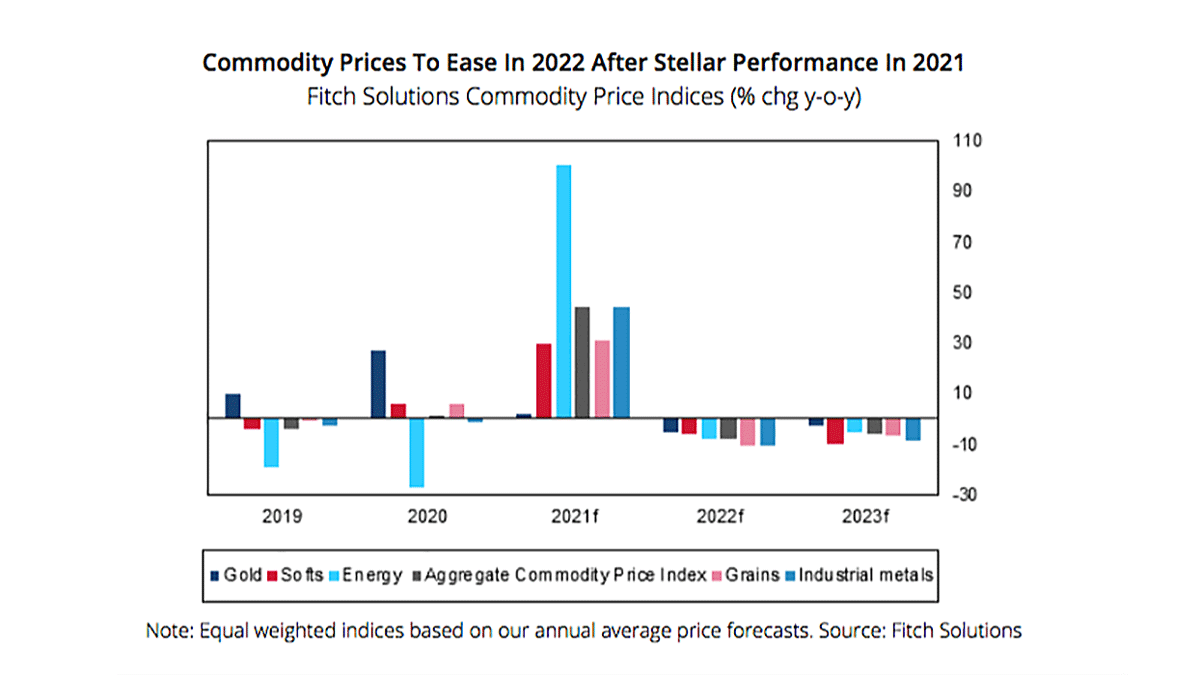

While the current increase in prices can be explained by the war in Ukraine, it also reflects the full deregulation of markets, which started forty years ago. The price of oil has increased four-fold in the last two years, that of gas by ten times in the same period, the price of wheat climbed by two times and a half…

Since Ukraine’s invasion by Russia, on February 24, the commodity prices have increased at record speeds. The shock is felt everywhere, starting with electricity and gas bills. The global rise in prices should be reduced by at least one percentage point and there is even talk of a recession for 2023.

Commodity prices in USD

- OPEC basket price, April 2022 – USD 105.09

- European Brent oil price, April 2022 – USD 104.30

- West Texas Intermediate oil price, April 2022 – USD 99.41

- Gold price/ounce, February 2022 – USD 1,856.46

- Aluminum price 99.5% minimum purity LME (London Metal Exchange) spot price, price/metric ton, November 2021 – USD 2,636.45

- Quality A copper price, LME spot price, price/ton, November 2021 – USD 9,728.90

- Price of iron ore imported from China 62% FE spot, price/metric ton, November 2021 – USD 90.13

- 99.97% pure lead price, LME spot price/metric ton, November 2021 – USD 2,329.98

- Uranium, NUEXCO, restricted price, price/metric ton, November 2021 – USD 31.10

Oil price dropping

Economically, the prospect of an accelerated monetary tightening once again raises fears of a slowdown in economic growth. The new European sanctions against Russia has also determined investors to be cautious.

In terms of oil, global prices fell after the US Senate approved a ban on oil imports from Russia. A day before, the International Energy Agency (IEA) had already indicated that the member states were to resort to a massive release from their strategic reserves; Japan said it would release 15 million barrels from its reserves, a record level. The oil price is about to register a significant decline, amid the release of stocks.