Strategic Materials and Energy Transition: Aluminium

Aluminium has seen tripling production in the last twenty years and green transition promises to use it increasingly more in low carbon technologies. In addition to pressure on resources, China’s domination over refining activities and the situation of dependence it involves, especially for Europe, the green economy needs this metal.

The ‘king of modern world’, essential in the global economy

Aluminium is the second-most abundant metallic element in Earth’s crust after silicon and the and the second most used metal after iron. It is particularly appreciated for its malleability, its natural resistance to corrosion, as well as its strength-to-weight ratio. Aluminium has become absolutely essential in our modern societies and can be found in many sectors of the economy, such as transportation, construction, the electrical sector or packaging.

Aluminium is increasingly used in low-carbon transition technologies. It is thus found in the battery case, as a cathode in lithium–nickel–cobalt–aluminium oxide (NCA) batteries and in hydrogen fuel cells. Due to its light weight, it is a privileged element of the nacelles and blades of the wind turbine, being found even in permanent magnets. As regards photovoltaic panels, it is widely used in frames and inverters. The electrical connection infrastructure is also passionate about this metal. Finally, the metal is widely used in the field of mobility because of its lightness as well as its resistance (Huisman et al., 2020).

Resources and reserves are in tropical and subtropical regions

The estimated resource of bauxite (Alu) is between 55 and 75 billion tons (Gt) globally (according to USGS, 2021). There are two main categories of bauxite deposits: karst bauxites, located mainly in the Caribbean (Jamaica), the Mediterranean Sea (Greece, France), China, Russia (Central Urals) and Kazakhstan; and lateritic bauxites, the main sources of world production being found in Africa (Guinea), South Asia (India), Australia, North and South America.

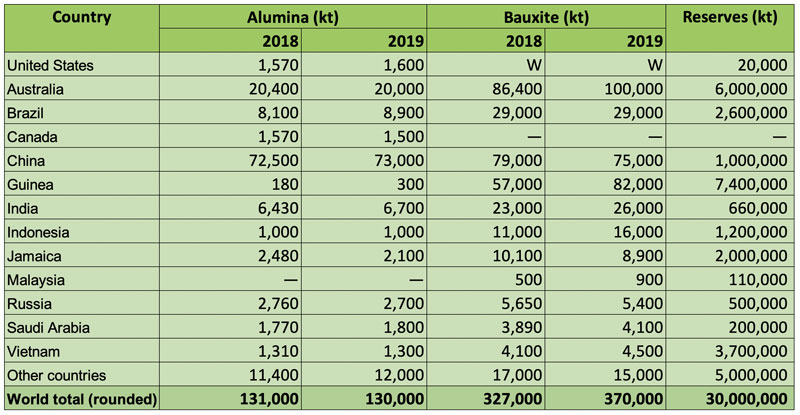

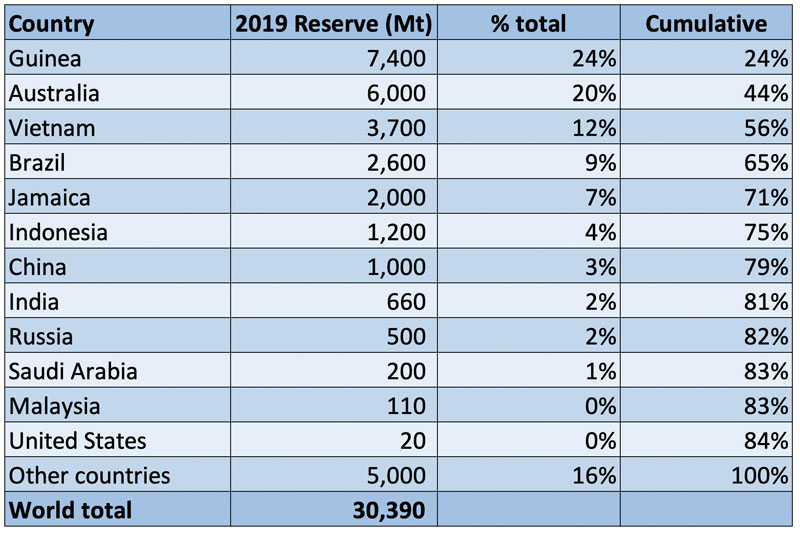

According to estimates provided by the US Geological Survey (2021), world bauxite reserves are not very concentrated and amount to 30 Gt. They are mainly located in tropical or subtropical areas: Guinea (24.9%), Australia (17.2%), Vietnam (12.5%), Brazil (9.1%) and Jamaica (6.7%).

The two countries with the highest bauxite reserves dominate mining; therefore, together, Australia (29.6%) and Guinea (22.1%) account for more than half of world mining production. China, whose reserves are limited (3.4%), still accounts for 16.2% of world production. This top three is completed by Brazil (9.4%), Indonesia (6.2%) and India (5.9%).

4 European countries produce bauxite

Greece, France, Hungary, and Croatia account for less than 1% of the global volume. Although Australia has been the largest producer of bauxite for more than two decades, its relative share in world production has declined (39% in 1996) due to increased production in West African and Southeast Asian countries (USGS, 2021). Having been virtually absent from the bauxite mining landscape, Indonesia made a sensational entry into the global rankings in 2011 and accounted for almost 20% of production in 2013, when the government decided to ban ore exports in January 2014, followed by the collapse of domestic production. Malaysia then experienced the same type of growth (12% of world production in 2015), before the Malaysian government in turn banned bauxite exports in 2016. The consequences were the proliferation of clandestine operations and environmental damage (OECD, 2019).

International groups owning mines

The sector’s mining landscape is dominated by large international groups that either fully own the mines or develop mining projects in joint venture with state-owned companies. There are established companies such as Alcoa (USA) or Rio Tinto (UK/Australia) with the newcomers of the 2000s, mainly Chinese companies (Bosai group in Chongqing, Chalco and Hongqiao group), and Emirates Global Aluminium (United Arab Emirates). Australian companies are also active in the field (Alumina Limited, South 32), as well as companies from India (Hindalco Industries), Norway (Norsk Hydro) and Russia (UC Rusal) (OECD, 2019).

Alumina, dominated by China

Alumina production has shifted from industrialized countries to countries with easy access to abundant resources and cheap electricity. It amounted to 136 million tons (Mt) in 2020, largely dominated by China (54%) whose production has grown very strongly since the 2000s. This increase in Chinese production has made it possible to reduce the country’s dependence on alumina imports, but now exposes it to fluctuations in the price of bauxite, from which it has to import almost half of its domestic consumption. Other producing countries are Australia (15%), Brazil (7%), India (5%) and Russia (2%). The top 10 alumina producers include four Chinese groups (Chalco and China Hongqiao, East Hope and Hangzhou Jinjiang groups), the US company Alcoa, the Anglo-Australian group Rio Tinto, the global company South32, UC Rusal, Norsk Hydro and finally India’s Hindalco.

Primary aluminium

In 2020, global production of primary aluminium reached 65 Mt, a level 2.5 times higher than in 2000, with a Chinese domination (56.7% compared to 8.6% in 1996). Far behind are India and Russia, each with a market share of 5.5%, followed by Canada (4.8%) and the United Arab Emirates (4%). There has been a decline in smelting capacity in OECD countries in recent years. For example, the United States, Canada, and Australia together accounted for more than a third of world aluminium production in 1996, compared to less than 10% today.

Compatible with the Paris Agreement

Due to its remarkable properties, aluminium will remain a flagship metal in our societies until 2050, especially in the case of a climate scenario compatible with the objectives of the Paris Agreement.

In order to determine the impact of increased aluminium demand on bauxite resources, research teams have calculated the cumulative consumption to resource ratios for the 2D and 4D scenarios. The USGS provides two estimates of bauxite resources: the smallest places them at 55 billion tons, while the largest puts them at 75 billion tons. In the most optimistic assumption, the criticality level associated with bauxite varies between 25.2% in the 4°C scenario and 63.9% in the 2°C scenario. These ratios are 34.4% and 87.1% respectively in the case of the most pessimistic estimate. The choice of the assumption therefore affects the geological criticality analysis. However, irrespective of the assumption selected, the ratios obtained in the 2°C scenario indicate high pressure on bauxite resources.

Environmental challenge

Aluminium is an essential material for the energy transition and its demand will grow massively by 2050. This metal will be a privileged ally in the lightening of vehicles and an essential element of electrical infrastructure, solar panels, and wind turbines. The International Aluminium Institute (2021) has calculated that in order to comply with the GHG reduction targets as defined in the International Energy Agency’s (IEA) Beyond 2°C scenario (B2DS), the carbon footprint of primary aluminium production would need to be reduced from more than 6t eqCO2/t of aluminium (world average in 2018) to 2.5t eqCO2/t. Such an increase would require an investment estimated at USD 0.5-1.5 trillion over the next 30 years. A carbon-free future therefore requires an increase in global production capacities. However, this key metal for the energy transition is also a source of greenhouse gas emissions. The aluminium industry is very electricity intensive.

In 2018, the sector alone accounted for 2% of global greenhouse gas emissions. The carbon intensity of the aluminium obtained is closely linked to the electricity mix of the producing country: in Europe, particularly in countries with decarbonized domestic production from hydroelectric dams, geothermal and nuclear power (Norway, France, Iceland), the production of one ton of primary aluminium generates around 7 tons of CO2 equivalent (CO2eq), while it produces more than 20 tons of CO2eq in China, where the electricity used in smelters generally comes from coal-fired power plants (European Aluminium, 2019).

While the carbon intensity of European primary aluminium production has already decreased by 55% since the 1990s, the effort required from China is much greater and could be a source of disruption of domestic supply.

A critical metal for the European Union

In the latest update of its list of critical raw materials (European Commission, 2020), the European Union has included bauxite for the first time. Used in many industrial ecosystems, bauxite is difficult to exploit in Europe, hence the EU’s strong reliance on imports (87%). A country supplies bauxite to the European Union in particular: Guinea. However, in a recent report (El Latunussa, 2020), the European Commission (EC) mentions the problematic nature of this dependence on a country whose governance is described as weak.

The EC also concludes that European demand for both primary aluminium and bauxite will increase by 2050 and indicates the risk of destabilization generated by Chinese appetite in these markets. Despite a 12-fold increase in its mining production since 1995, China now absorbs two-thirds of global bauxite imports (OECD, 2019). Europe therefore seems to be aware of the uncertainties affecting the supply of aluminium, weaknesses that could be exacerbated in a context of rapid and widespread global demand.

Recycled aluminium, much smaller carbon footprint

Aluminium is easy to recycle and can theoretically be reused again without losing its remarkable properties. Therefore, the limiting factors lie mainly in the efficiency of collection systems and in long downtime in the transportation or construction sectors, for example. This secondary production has a double advantage: firstly, secondary aluminium has a much smaller carbon footprint, which makes it an essential element in the decarbonization strategy of this industry; secondly, secondary production improves security of supply in consuming countries and, in addition, one third of European supply is already satisfied through recycling (EC, 2020).

Conclusions

A metal with remarkable properties, aluminium will remain a flagship metal in our societies until 2050 due to its increasing use in low carbon technologies.

The risks this metal is exposed to are:

- Geologic: the TIAM-IFPEN model anticipates a high degree of geological criticality for bauxite resources in a 2°C scenario.

- Economic: global production of alumina and primary aluminium is largely dominated by China.

- Strategic: Europe is heavily dependent on imports of bauxite, which has recently been declared a critical raw material by the European Commission.

- Environmental: as a source of greenhouse gas emissions, the aluminium industry is expected to undergo a profound change in the coming years.