Strategic Materials and Energy Transition: Lithium

As cobalt, lithium is a key material in Li-ion batteries. Over the past few years, the demand for lithium has increased at a steady rate of approximately 20% per year. This trend seems to continue in the future, with the increased electrical mobility as part of the ecological transition. However, it is not so much the geological risk that is worrying for this metal as the high concentration of reserves, production, and the market, as well as China’s control position on the value chain.

In September 2020, the European Commission presented a 10-action plan to secure supply of critical raw materials for EU economies, on which occasion it supplemented the list, with new substances necessary for strategic technologies and sectors. The list of critical raw materials has 30 positions, and among the newly added is lithium, which is essential for batteries needed to switch to electric mobility, as well as for energy storage.

“If we only refer to electric car batteries and energy storage, Europe will need lithium, for example, up to 18 times more by 2030 and up to 60 times more by 2050. We cannot replace our current reliance on fossil fuels with one on critical raw materials,” said the Vice-President of the European Commission, Maroš Šefčovič.

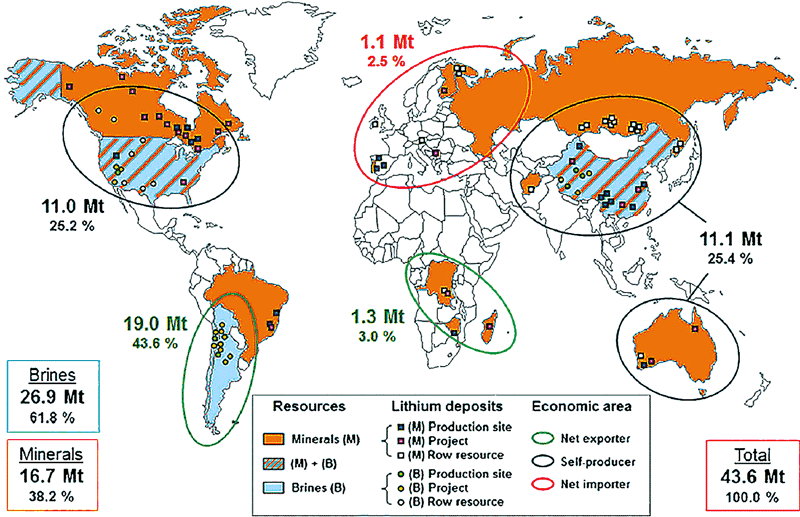

Lithium is in relatively abundant supply in the earth’s crust, being the 32nd most represented element among the 83 significantly represented elements. In 2008, most of the known lithium resources were contained in two types of deposits: so-called ‘conventional’ deposits, i.e., salar brines (62%) and lithiniferous rocks (27%, with a significant proportion of spodumene) and so-called ‘nonconventional’ deposits, i.e., hectorite (clay) (7%), geothermal brines (1%) and oil fields (3%) (Evans, 2008; Bradley, 2017).

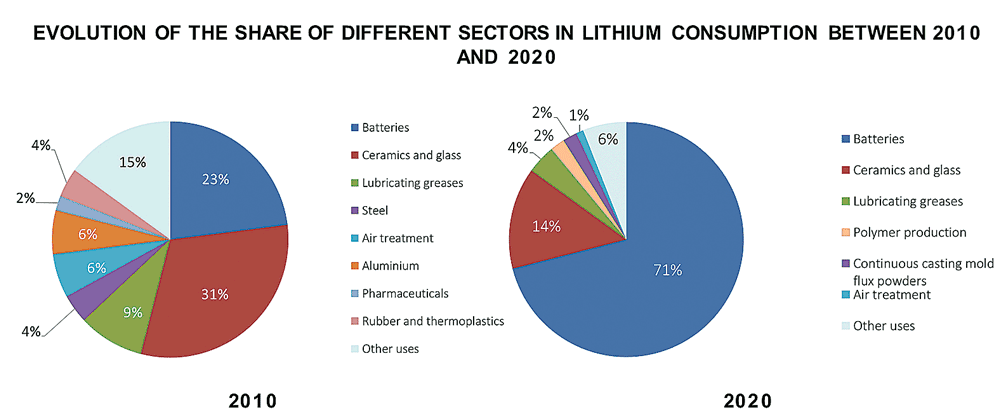

Initially, lithium was mainly used for glass and ceramic manufacturing, for lubricating greases, or for the production of aluminium. Currently, it is used to produce lithium-ion batteries of electronic devices or electrified vehicles. The share of batteries in total lithium consumption has increased significantly, currently accounting for 71%, compared to 23% in 2010.

Of the 86 million tons of lithium resources identified in 2020, almost 60% are owned by the three Andean countries forming the ‘Lithium Triangle’: Bolivia (21 Mt), Argentina (19,3 Mt) and Chile (9,6 Mt). Significant resources have also been identified in the United States, Australia, China, the Democratic Republic of Congo, Germany, Canada, and Mexico.

Lithium reserves are estimated at 21 million tons (Mt) in 2020, compared to 13 Mt in 2010, of which half are held by Chile and Argentina alone.

The concentration of mining production is intensifying

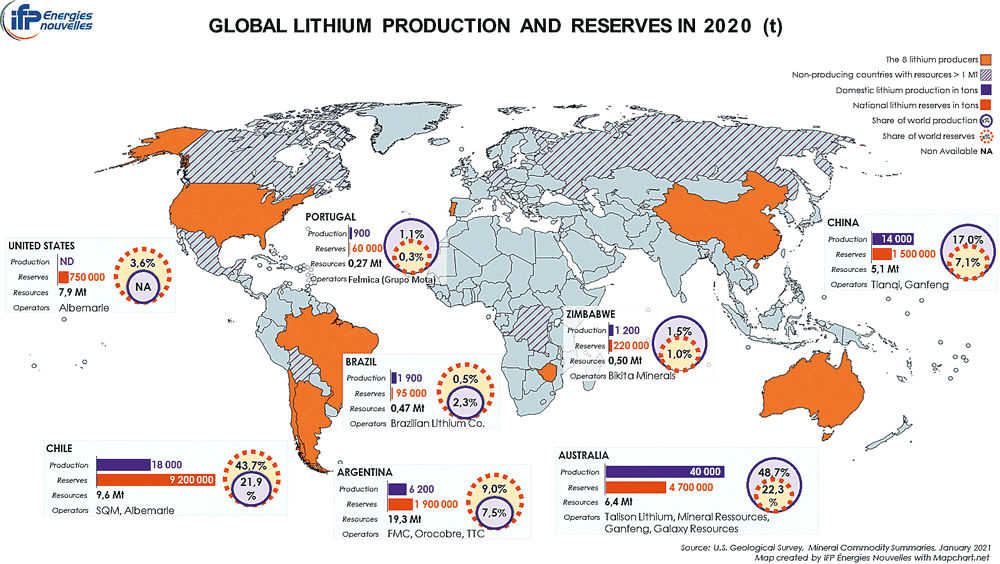

Global lithium production has tripled in a decade, from 25,000 tons in 2010 to over 82,000 tons in 2020. The geographical concentration of lithium has increased in the last ten years and is today higher than that of reserves (HHI of 3,203 in 2019 against 2,779 in 2010) (USGS, 2011 and 2020).

Today, two regions – Australia and Latin America – concentrate 80% of mining production, even if through the game of industrial participation, the concentration of production is not reduced to these two geographical areas. Australia became the world’s largest producer in 2018 (48.7% of world production), followed by Chile (21.9%), China (17%) and Argentina. The absence of Bolivia from the mining landscape can only be astonishing when we consider that the Uyuni Saltworks are the largest lithium resources in the world.

Five major players control the market

The lithium market is controlled by a very small number of large multinational companies – the top 5 – which have integrated the entire value chain of lithium, from mining production to the production of chemical compounds (products with high added value).

These five players include the three historical producers: Chilean company SQM (Sociedad Química y Minera de Chile), American companies Livent (ex-FMC Corp) and Albemarle Corp. The other two members of this ‘top 5’ are the two Chinese companies Tianqi Lithium and Jiangxi Ganfeng Lithium. They have entered the market much more recently and have first invested in mining abroad, before developing expertise in the lower end of the value chain (Grant et al., 2020). Approximately two thirds of production is reportedly controlled by Albermarle, SQM and Tianqi in 2019, which suggests a potential cartelization of production of this strategic ore (Escande, 2018).

The particular position of Tianqi and the partnerships established with two of its competitors also draw attention: Tianqi operates the Greenbushes deposit in Australia, one of the largest mines currently in operation, together with Albermarle and holds a 24% interest in the SQM Group.

More transparent prices, soon?

Global lithium production and the pace of development of mining or exploration projects are closely related to the selling price of lithium. However, the information about the price of this metal is not easily available, especially when it comes to its unprocessed and refined forms.

Lithium is entering a new era of transparency after years of being notoriously opaque due to private contracts and having not been historically traded on a public platform, according to Ken Brinsden, CEO and managing director of Australian lithium producer Pilbara Minerals Ltd.

New measures in 2021, such as the London Metal Exchange’s battery-grade hydroxide cash-settled futures contract launched in July and the Battery Material Exchange, or BMX, platform through which Pilbara Minerals has now held two auctions for 10,000-ton and 8,000-ton cargoes, is helping to facilitate this transparency.

This transparency will lead to more financial instruments, greater investment and more production of lithium, Ken Brinsden said.

Lithium resources and anticipated risks

The IFPEN research team used the TIAM-IFPEN model to assess the cumulative demand for nickel by 2050 based on two climate scenarios: a scenario called 4°C corresponding to an increase in temperature of 4°C at higher pre-industrial levels (4D scenario) and a more ambitious climate scenario that limits the rise of temperatures to 2°C (2D scenario).

Then it applied two mobility scenarios to each of these climate scenarios: the first, in relation to mobility ‘Business As Usual’ (BAU), corresponds to a continuous growth of properties and a greater dependence on vehicles. The second refers to sustainable mobility, where the use of public and non-motorized transport is favoured, as well as an integrated approach to planning and investments in the use of land and urban transport.

Reflecting the evolution of the global fleet of electric vehicles and therefore the demand for lithium, the production of lithium extraction seems to be higher in the case of ambitious climate scenarios. In a 4D scenario, cumulative mine production between 2005 and 2050 is estimated at 15.7 Mt for the sustainable mobility scenario and 16.8 Mt for BAU mobility, while in a 2°C scenario these same demands reach respectively 24,3 Mt and 27.1 Mt.

Reduced transparency of the lithium market

The rapid increase in the demand for lithium will require the development of new mines in the following years. However, it may take up to 10 years for a deposit to be operational. On the other hand, part of the current production is not very flexible in the short term: while the mines that operate spodumenes (Australia) can adapt their production quite fast, the exploration of Andean salt flats involves an evaporation process that requires up to 18 months. In the end, the junior or middle-sized companies fight to find the necessary funds to develop these capital-intensive projects, a problem that is accentuated by the reduced transparency of the lithium market (Lefebvre and Tavignot, 2020).

A metal produced to the detriment of the environment

Lithium industry has an impact on the environment, whose intensity depends on the extraction method. This impact refers mainly (at the beginning of 2020) to the following.

- CO2 emissions: 15 tons of CO2 are needed on average to produce one ton of lithium in the case of hard rock mining and 5 tons for underground reservoirs.

- Water use: 469 m3 of water is required to produce one ton of lithium. In Chile, indigenous communities and environmental groups are increasingly opposed to lithium mining activities in the Atacama Salt Flat because of the pressure it exerts on freshwater resources (Sherwood, 2019).

- Land use: Lithium production through the mining of underground reservoirs monopolizes 3,124 m2 of land per ton produced. Huge evaporation basins thus disfigure entire landscapes in the Andean salt flats.

Environmental impact related to lithium extraction and increased pressure of the environment around the carbon footprint of ecological transition technologies have generated a strong interest in green lithium, i.e., lithium from geothermal waters. For the same volume of lithium extracted, this method would therefore consume 150 times less water and 3,000 times less land than the operation of underground reservoirs (Early, 2020). Geothermal lithium reserves have been located in the United States, but also in Europe (Germany, France, the UK).

The idea of lithium “made in Europe” is also particularly attractive for the European Union, whose industrial ambition is to reduce its reliance on China and Asia in general, in the segment of batteries intended for electrified vehicles. This ambition has reflected in the launch in 2017 of the European Alliance for Batteries, a project supported by the European Commission and bringing together more than 500 public and private players in the sector.

China, the largest consumer of lithium in the world until 2050

China has only 7% of lithium reserves but has a much higher level of control over the value chain. China’s apparent weakness in the mining sector should be qualified: 17% of extractions come from Chinese soil in 2020, but Beijing actually has more control over mining thanks to Ganfeng and Tianqihold shares in numerous mining projects and competing companies around the world (Lefebvre and Tavignot, 2020).

Moreover, Australia sends to China 80% of its mining production for processing, refining and consumption. Chile carries out some of its processing activities, but leaves refining to Japan, South Korea, and China. Beijing would thus control between 50% and 89% of the refined lithium production at global level (LaRocca, 2020).

China has finally moved down the value chain by investing in energy storage technologies. In 2018, it accounted for 61% of the global production capacity of lithium-ion batteries (Desjardins, 2018). Also, the results of the model confirm that the ambitions of the Made in China 2025 plan in the field of electrified vehicles (Hache, 2019) should maintain China in the position of the largest consumer of lithium in the world until 2050.

This strong reliance of the global market on the Chinese processing and refining activities, together with an increasing appetite for lithium in China, may call into question the future security of supply.

The Lithium Triangle: national strategies with uncertain consequences

The Lithium Triangle concentrates 58% of the world’s resources, 53% of the reserves and 29% of the global production of ore (USGS, 2021) and, according to the results of the IFPEN team, it is expected that the region will become the main exporter of lithium in 2050, with 90% of the global supply. The place held by each of the countries in the region in international trade is also closely related to their national policies.

In Argentina for example, the climate conducive to foreign investments has allowed the exploration projects and the development of new mining sites to take off. Chine, in turn, undermined by the internal opposition and hampered by the opacity of its legal and regulatory framework, has not been able to maintain its position in global lithium production. In the end, Bolivia hasn’t entered yet the global market, due to the lack of technological knowledge in the field.

The dynamics of long-term balance in the commodity markets teach us that the absence of geological criticality does not exclude other risks (economic, industrial, geopolitical, or environmental). In particular, competition between players appears quite relative on the lithium market, despite the entry of new companies, and the policy of China and its companies, in the lithium sector, but also on the battery market, remains a key element in understanding the lithium market in the future.

Conclusions

Lithium is increasingly being used in lithium-ion batteries for electronic devices or electrified vehicles (EV) but reserves and resources are expected to be sufficient to meet needs until 2050.

The risks related to lithium are not so much geological as they are:

- Geostrategic: the reserves and production are increasingly concentrated geographically, with the lithium triangle concentrating 58% of resources and 53% of reserves, and Australia and Latin America 80% of mining extraction;

- Economic: prices are not transparent, which affects the production and development of mining projects; 5 global players control most of the mining production, as well as the entire value chain, China exercising a particularly strong control over the processing and refining activities;

- Environmental: lithium production emits CO2 and consumes water in particular; in addition, the exploitation of underground reservoirs monopolizes the land and evaporation basins disfigure the landscapes in the Andean salt flats.