Walking a Tightrope: Natural Gas Prices Hit New Heights

According to the recent Quarterly Gas Review from the Oxford Institute for Energy Studies (OIES) the natural gas market could effectively ‘walk a tightrope’ through the winter as the market tightness will persist, resulting in an extended period of relatively high prices.

More than a year from the onset of the health crisis that kept mankind in lockdown for several months, global economy seems to show visible signs of syncope, especially as regards provision of raw materials (or rather their transport), which led (is this only the beginning?) to price increases and delays in product delivery.

The cost of natural gas and electricity has surged across Europe, reaching records in some countries, as businesses re-open and workers return to the office. In Europe, plans to decarbonize the economy are also playing a part as utilities pay near-record prices to buy the pollution permits they need to keep producing power from fossil fuels.

The gas industry does not seem to be left unscathed by these disruptions in an economic chain whose missing links seem to spread more shock waves than we would have expected.

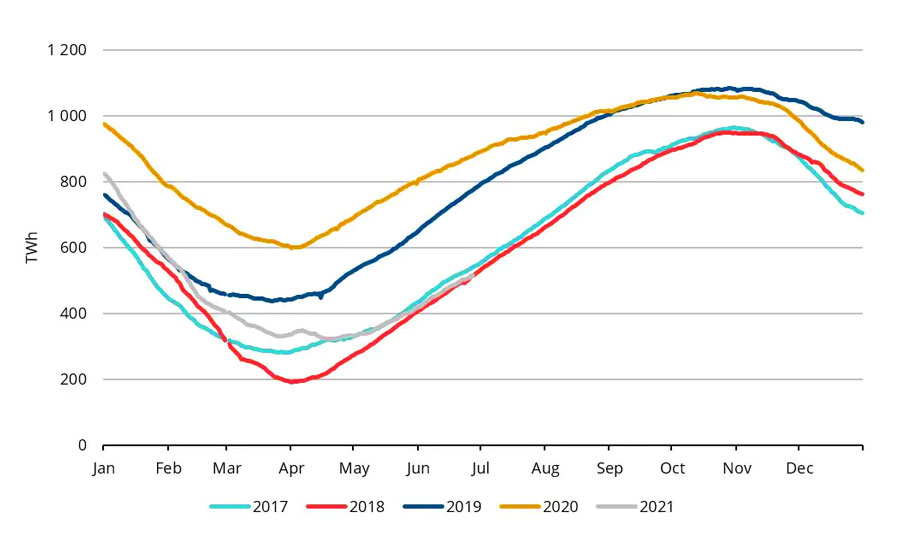

A ‘headline issue’ of recent months that has gone together with the gas price rally was the dramatic draw-down of European storage stocks in the winter of 2020/21, and the subsequent slow rate of storage injections that has accompanied the sustained high European price levels.

In Q2 2021, the most notable development has been the slow pace of stock replenishment. A return to net withdrawals in the second half of April meant that stocks on 1 May were lower than on 1 April, thus delaying the start of the injection season by a month. Since then, injections have proceeded slowly. As a result, stocks held on 27 July 2021 (58 bcm) were slightly lower than on 27 July in 2017 and 2018 (62 bcm and 60 bcm, respectively), and significantly lower than stocks held on 27 July in 2019 (83 bcm) and 2020 (88 bcm). For stocks to reach even 80 bcm, by the end of the injection season in October 2021, net storage injections will need to accelerate in the coming months.

Starting the winter with significantly lower stocks than has been usual for the past several years will reduce the ‘buffer’ that Europe must cope with market fluctuations during the coming winter, thereby increasing the likelihood of price surges should any significant shift in the supply-demand balance occur, for example due to weather or supply issues.

Therefore, European Union’s gas reserves are way below the normal levels and if they are not supplemented by October the Community bloc could face problems in terms of prices, like those from last winter, analysts warn. The European Union has the capacity to store over 117 billion cubic meters of natural gas, or approximately one fifth of its annual consumption, according to Gas Infrastructure Europe. The storage facilities were full a year ago, which allowed the Community bloc to withstand without any problems an unusually long winter, which has caused global gas prices to rise since January.

“Going into the current winter with less in storage, Europe is walking a tightrope – and it wouldn’t take a huge gust of wind to knock us off,” said Jack Sharples, a research fellow at the Oxford Institute for Energy Studies. “All it would take is for some (liquefied natural gas) projects currently offline to not come back on, or some unplanned maintenance on a pipeline bringing gas into Europe, or just another cold winter.”

Currently, EU storage facilities are filled to only 60 percent capacity, or just under 70 bcm of gas. That needs to get up to at least 80 bcm by October 1 to ensure a proper buffer against market fluctuations through winter, Sharples added.

The EU has the capacity to store over 117 billion cubic meters (bcm) of natural gas, or roughly a fifth of its annual consumption, according to Gas Infrastructure Europe.

Data from the IEA showed European gas consumption rose by an estimated 25% in the second quarter of 2021, its largest year-on-year quarterly increase since at least 1985.

“A rise in gas and power retail tariffs will come as a shock to users this winter. Wholesale prices are still rising along with other generating fuels globally so there is no clear end in sight yet,” said Glenn Rickson, head of European power analysis at S&P Global Platts.

In turn, James Huckstepp, gas analyst at S&P Global Platts, mentioned that “Europe managed to get through last winter relatively unscathed, as we had such high storage stocks at the start”.

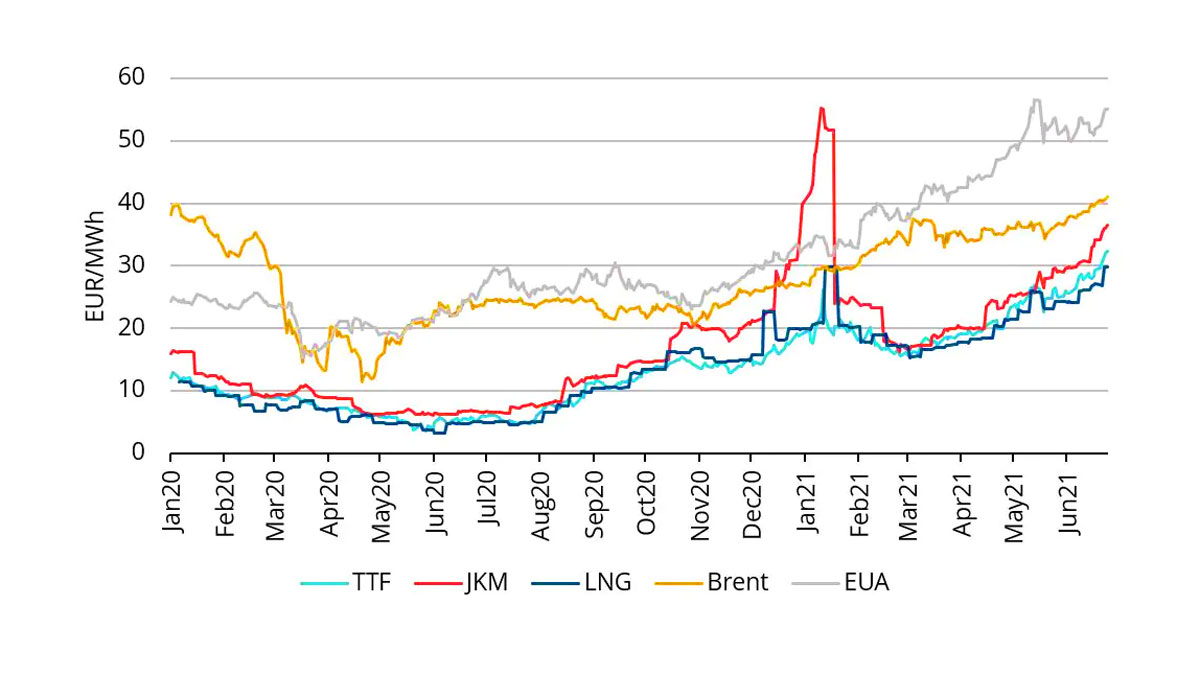

Prices collapsed during the lockdown due to extremely low consumption

Part of the reason why the stocks were so high in 2020 was that the pandemic blocked the economy, creating a massive supply source that made prices fall to USD 3 per million British Thermal Units (mmBTU). Also, in March 2020, Europe cancelled US LNG shipments, which would have ensured a gas quantity higher than needed at the moment.

Nord Stream 2: only 15 kilometres left to be built

Under these circumstances, regional gas supply, for smaller distances, seems to be the emergency solution or even the winning one in the long run. In August 2021, Russian President Vladimir Putin mentioned that only 15 kilometres were left to be built until the completion of Nord Stream 2 gas pipeline, which will carry gas from Russia to Germany. After talks with German Chancellor Angela Merkel, who visited Moscow, the Kremlin leader said Russia intended to fully comply with obligations on gas transit through Ukraine.

Vladimir Putin said Moscow was ready to deliver gas through its neighbour even after 2024, but Russia should first understand the scale of demand for its fossil fuels. “And for that we need to get an answer from our European partners on how much they are ready to buy. We cannot sign a transit contract if we don’t have supply contracts with our consumers in Europe,” Russian President mentioned.

Gas prices exploded

Nord Stream 2 is awaited with great hopes by all those involved, as European gas prices have reached record levels this year due to low LNG supply. In mid-August 2021, gas prices reached in Europe a new record, exceeding the threshold of USD 585/thousand cubic meters. The increase comes after Russia’s decision to cover only 4% of the additional gas transit capacity offered by Ukraine for September. “Russia is currently the only country that could have a surplus production, but to increase its exports it should book additional capacities through Ukraine,” indicated Platts, the price index evaluation organization. The representatives of the organization also said that the price of natural gas in Europe is caused by the increased demand, after a cold winter and by the decrease of other sources of supply. “A decrease in Mallnow (gas station) flows reduced Russian imports by 30-45mcm/day as of July 31. Although historically Gazprom supplies were secure and problems were solved quickly and we expect the flows to return to over 80 mcm/day, Gazprom’s strategic evolution to focus on value in relation to volume in 2020-2021 could bring lower flows for longer”.

Despite the dramatic rise in European hub prices in Q2 2021, on the back of a tightening supply-demand balance, Gazprom’s sales via its Electronic Sales Platform (ESP) were once again limited in volume, and sales for near-term delivery were almost entirely absent.

In Q2 2021, Gazprom sold 3,029 mmcm via the ESP, which was a significant rebound from the 813 mmcm that was sold via the ESP in Q1 2021. However, the sales in Q2 2021 were lower than those in Q2 2019 (3,741 mmcm) and Q2 2020 (9,881 mmcm).

Gazprom should have ensured the transit of 40bcm of gas per year through Ukraine and purchase additional capacities if needed. This in conditions in which Russia purchases an important additional transit capacity when its gas pipelines that bypass Ukraine supply gas to Europe at full capacity.

The tightening global gas market

According to the Oxford Institute for Energy Studies, the rapid rise in global gas prices this year has reflected a tightening global gas market. The reasons for this have been widely discussed within the industry by participants and commentators. The cold winter prompted a significant rise in demand, especially in Northeast Asia, and strong demand has continued as the world economies recover from Covid-19. Supply has also been constrained by a few issues surrounding LNG plants around the world as well as Nord Stream 2 not being completed.

With European hub prices climbing to record levels for this time of year, a question that has been increasingly asked by analysts is whether Gazprom – as the single largest supplier to the European market – is pursuing a sales strategy that aims at leveraging its market power to maintain such prices.

Specifically, is Gazprom ‘holding back’ volumes to ensure the market remains tight, by not booking (and utilising) additional transit capacity via Ukraine?

OIES Quarterly Gas Review’s conclusions

To conclude, the overall picture in Q2 2021 was that of a tight market at a global level for LNG (as evidenced by OIES ‘LNG tightness’ analysis) and in Europe (accompanied by higher coal and carbon prices). Looking forward to both Q3 2021 and the coming winter of 2021/22, it is possible that this market tightness will persist, resulting in an extended period of relatively high prices. This certainly seems to be the market sentiment, given the forward prices in Europe (TTF) and Asia (Argus NorthEast Asia) through to Spring 2022. Throughout Q3 2021, the signposts we will continue to look for are the rates of storage injection in Europe, the start-up of Nord Stream 2, and developments at LNG export terminals that could bring back supply that is temporarily offline, plus new projects coming onstream.

All these factors will influence the supply available to the global market, and by extension, the market situation at the start of winter. In the near term, Q3 2021 seems likely to experience a continuation of the trends seen in Q2 2021. Looking further ahead if the global market enters the winter period with lower-than-usual storage stocks in Europe, Nord Stream 2 not coming on during the winter, substantial LNG export capacity possibly still offline, and demand continuing to rebound, the market could effectively ‘walk a tightrope’ through the winter: a mild winter could pass without incident, but either a weather-related demand surge or a supply-side disruption could see prices once again surging, as they did in January 2020.