Electrolyzer Manufacturers to Keep Gigafactory Momentum

Manufacturers across the world could be producing more than 100 GW of electrolysers per year, according to a research paper from Rethink Energy entitled ‘The Swelling Pipeline of Electrolyzer Gigafactories’.

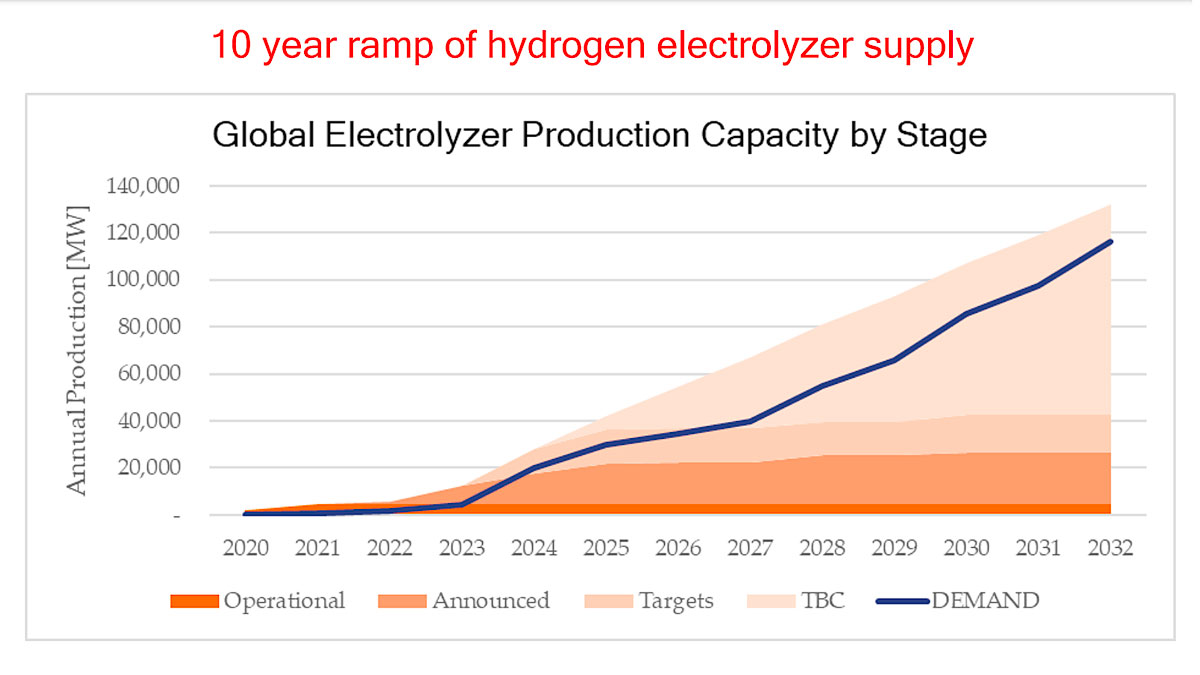

A flurry of announcements over the past three years has seen the factory pipeline swell to levels that put the industry on track to satisfy demand over the next five years. Maintaining this momentum will be crucial for the surge in green hydrogen to follow thereafter.

In 2020, the production capacity for electrolyzers was just 2 GW globally, sitting substantially higher than the world’s total installed capacity of 300 MW. This was at a time when the conversation around hydrogen was dominated by doubt. But now, things have changed.

Hydrogen has been identified as a key technology for the decarbonization of heavy-duty transport, heating, industry, feedstocks, and long-duration energy storage. Rethink Energy’s latest report anticipates that by 2050, global hydrogen demand will have grown ten-fold to 735 million tons, with almost all of this being produced using electrolysis.

The boom has already started, with nearly 40 GW of electrolyzers set to be installed in the next 5 years alone.

A herculean effort will be required to build enough factories to support such a build out – but the market leaders are ready. As are a handful of new-entry innovators.

ITM Power completed the world’s first electrolyzer Gigafactory in January 2021 in the UK, and announcements have snowballed since. Over the past two years, western electrolyzer manufacturers have committed to building factories that can produce over 42 GW of electrolyzers per year by 2030. Locations have already been secured for nearly two-thirds of this.

“Such factories only take around two years to build,” notes Harry Morgan, Rethink Energy’s hydrogen analyst and lead author of this report, “meaning that at the current rate of these announcements, we’re predicting that developments will keep pace with electrolyzer demand over the next 10 years”.

“New plants, with a combined capacity of around 12 GW per year, will have to be announced and added every year between 2026 and 2032, giving electrolyzer manufacturers several years of runway in their pipeline factories,” adds Morgan.

In total, around USD 6 billion will have to be invested in the construction of these new factories.

Fourteen different manufacturers now have plans for an electrolyzer Gigafactory, across twelve different countries. There will be space for different chemistries – PEM, AEM, and SOE to name a few – as the specific requirements for electrolysis plants varies from site-to-site.

Such gigafactories will be crucial in reaching the much-needed economies of scale for green hydrogen. By 2024, several OEMs will be providing systems than can produce green hydrogen at a lower cost than ‘grey’ hydrogen, produced using natural gas.

The ability to produce small-scale, modular electrolysis cells, at scale, will make hydrogen accessible for swathes of industries that need it to decarbonize. Just as solar modules have in power generation, and batteries have in the EV space, electrolyzers will outperform expectations.

Rethink Energy predicts that even without any sudden improvements in technology – of which several are almost certain – the learning rate for electrolyzer units will be 14%. This will see the capital cost of electrolyzer units fall from around USD 1,400 per kW to USD 340 per kW by 2030, as global capacity rises to nearly 100 GW.

Incremental improvements in efficiency and capacity factor will also see a reduced demand for electricity, which itself will be falling in price. With similar economies of scale, the cost of solar power will fall below USD 20 per MWh by the end of the decade, accounting for 37% of the overall cost reduction of green hydrogen. By 2030, the global average cost of green hydrogen will have fallen to USD 1.50 per kilogram.

Rethink Energy is the energy research arm of Rethink Technology Research focusing on the business of energy transition, renewable and their investment possibilities.