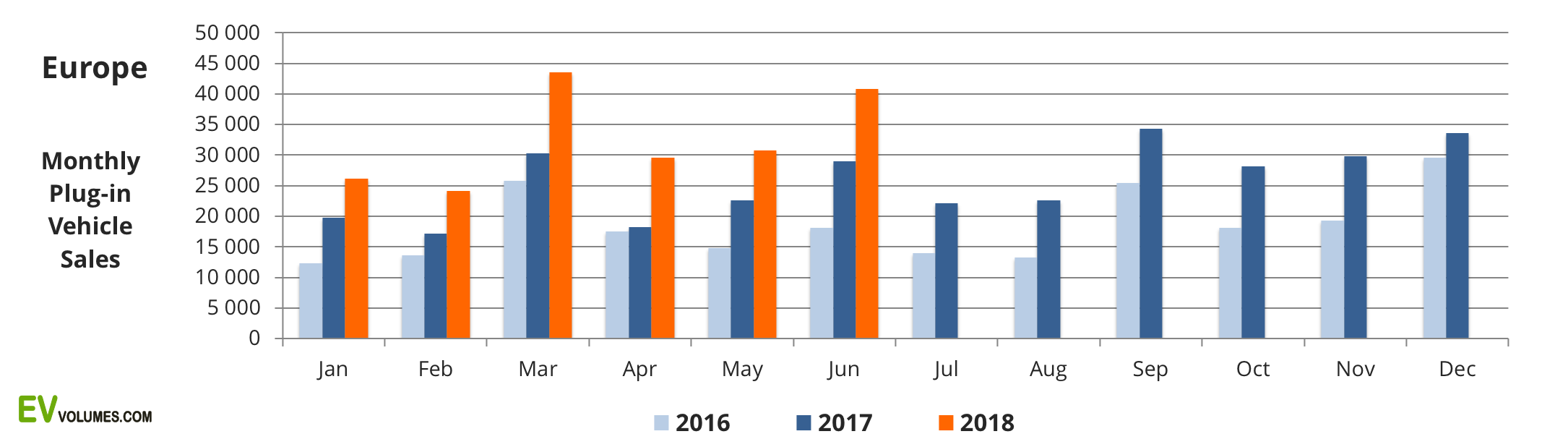

Electric vehicles sales in Europe surpassed 1 million

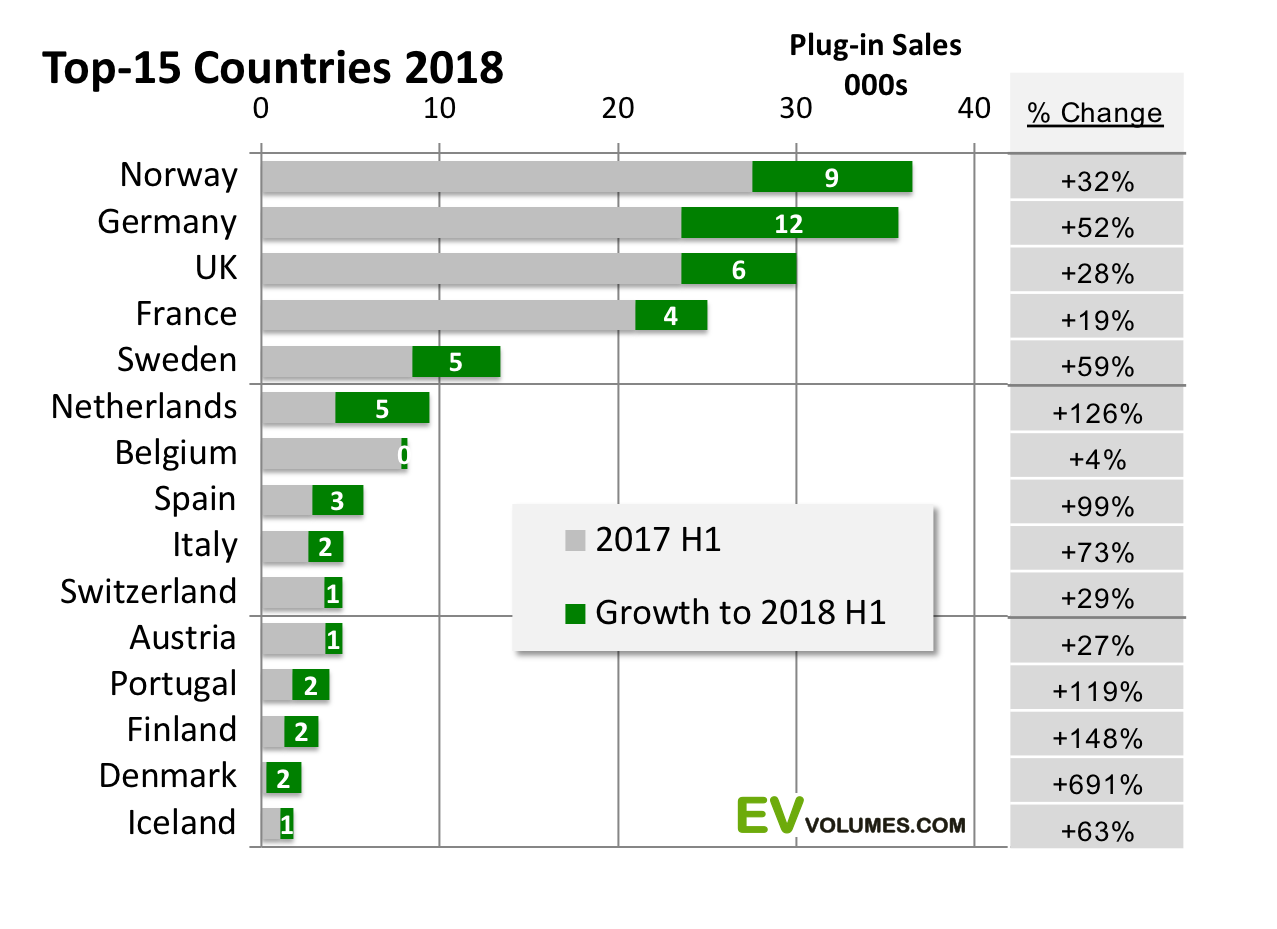

There are now more than 1 million electric vehicles in Europe, according to new figures. Norway is Europe’s largest market, though Germany looks set to overtake it by the end of the year. Still, electric vehicles accounted for just 2% of new registrations in Europe between January and June.

“Norway still leads the European country ranking. 36 500 plug-ins were delivered including June and for the complete 2018 we expect 84 000 sales, a share of 45 % in Norway’s market for passenger cars + light commercial vehicles. Germany sales grow faster, though, and we expect it to take the volume lead in Europe with 88 500 registrations when 2018 is closed,” EV Volumes database reports.

930 000 Plug-ins were on European roads at the end of 2017. Adding the 430 000 of 2018 and accounting for some scrapping, their number will increase by 45 %, to approximately 1350 000 at the end of 2018.

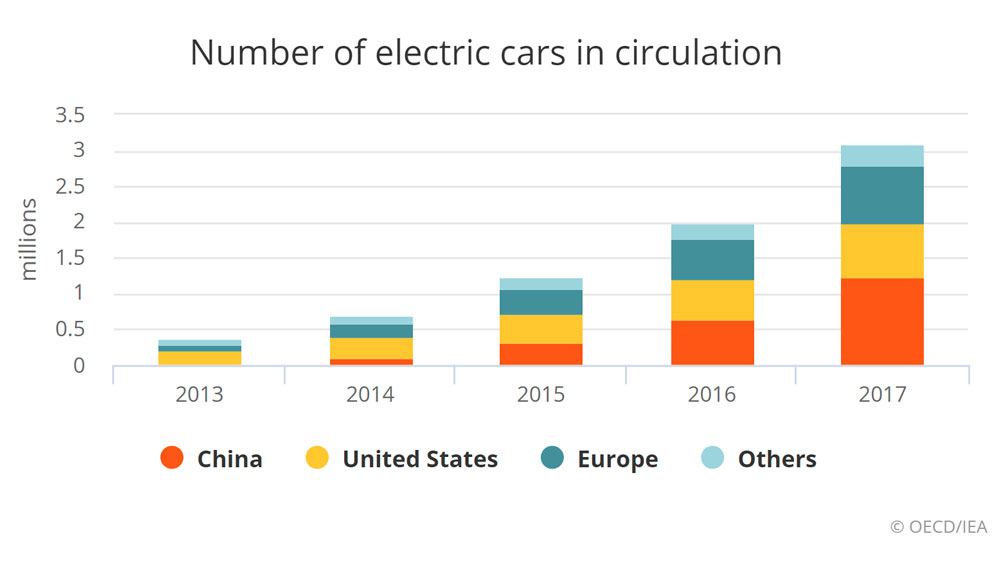

The number of electric and plug-in hybrid cars on the world’s roads exceeded 3 million in 2017, a 54% increase compared with 2016, according to the latest edition of the International Energy Agency’s Global Electric Vehicles Outlook.

China remained by far the largest electric car market in the world, accounting for half sold last year. Nearly 580,000 electric cars were sold in China in 2017, a 72% increase from the previous year. The United States had the second-highest, with about 280,000 cars sold in 2017, up from 160,000 in 2016.

Nordic countries remain leaders in market share. Electric cars accounted for 39% of new car sales in Norway, making it the world leader in electric vehicle market share. In Iceland, new EV sales were 12% of the total while the share reached 6% in Sweden. Germany and Japan also saw strong growth, with sales more than doubling in both countries from their 2016 levels.

Electric mobility is not limited to cars. In 2017, the stock of electric buses rose to 370,000 from 345,000 in 2016, and electric two-wheelers reached 250 million. The electrification of these modes of transport has been driven almost entirely by China, which accounts for more than 99% of both electric bus and two-wheeler stock, though registrations in Europe and India are also growing.

Charging infrastructure is also keeping pace. In 2017, the number of private chargers at homes and workplaces was estimated at almost 3 million worldwide. In addition, there were about 430,000 publicly accessible chargers worldwide in 2017, a quarter of which were fast chargers. Fast chargers are especially important in densely populated cities and serve an essential role in boosting the appeal of electric vehicles by enabling long-distance travel.

The growth of electric vehicles has largely been driven by government policy, including public procurement programmes, financial incentives reducing the cost of purchase of electric vehicles, tightened fuel-economy standards and regulations on the emission of local pollutants, low- and zero-emission vehicle mandates and a variety of local measures, such as restrictions on the circulation of vehicles based on their pollutant emission performances.

The rapid uptake of electric vehicles has also been helped by progress made in recent years to improve the performance and reduce the costs of lithium-ion batteries. However, further battery cost reductions and performance improvements are essential to improve the appeal of electric vehicles. These are achievable with a combination of improved chemistries, increased production scale and battery sizes, according to the report. Further improvements are possible with the transition to technologies beyond lithium-ion.

Innovations in battery chemistry will also be needed to maintain growth as there are supply issues with core elements that make up lithium-ion batteries, such as nickel, lithium and cobalt. The supply of cobalt is particularly subject to risks as almost 60% of the global production of cobalt is currently concentrated in the Democratic Republic of Congo.

Additionally, the capacity to refine and process raw cobalt is highly concentrated, with China controlling 90% of refining capacity. Even accounting for ongoing developments in battery chemistry, cobalt demand for electric vehicles is expected to be between 10 and 25 times higher than current levels by 2030.

The report notes that ensuring the increased uptake of electric vehicles while meeting social and environmental sustainability goals requires the adoption and enforcement of minimum standards on labour and environmental conditions. The environmental sustainability of batteries also requires the improvement of end-of-life and material recycling processes.

Looking forward, supportive policies and cost reductions are likely to lead to continued significant growth in the EV market. In the IEA’s New Policies Scenario, which takes into account current and planned policies, the number of electric cars is projected to reach 125 million units by 2030. Should policy ambitions rise even further to meet climate goals and other sustainability targets, as in the EV30@30 Scenario, the number of electric cars on the road could be as high as 220 million in 2030.

The IEA’s latest Tracking Clean Energy Progress report shows that electric vehicles are one of the 4 technologies out of 38 that are on track to meet long-term sustainability goals.

IEA’s outlook still leaves plenty of room for fossil fuel-powered vehicles. Forecasts put the world’s total car count at roughly 2 billion somewhere in the 2035 to 2040 window. However, the IEA also sees a pathway to 220 million electric vehicles by 2030, provided the world takes a more aggressive approach to fighting climate change and cutting emissions than currently planned.

While battery costs are falling, the IEA acknowledges that government policy remains critical to making EVs attractive to drivers, spurring investment and helping carmakers achieve economies of scale.

“The uptake of electric vehicles is still largely driven by the policy environment,” the IEA’s report says. “The 10 leading countries in electric vehicle adoption all have a range of policies in place to promote the uptake of electric cars.”

Policies in place today will make China and Europe the biggest adopters, in the IEA’s view.