Investing During the Crisis: Palladium

Although palladium is the most notorious in the automotive, chemical, or dental industries, in the eyes of the general public it is yet the least known, and also the least traded.

Investing in palladium means choosing a rare metal that can serve as a monetary reserve in the face of economic crises. Its lack of popularity, compared to gold, allows profitable and sustainable investments at prices equivalent to those of gold.

Return on investment

If we look at the history of palladium price, we realize the incredible potential of this white metal. The price per gram has witnessed an exponential profitability, but the investment is not intended to obtain fast gains but is rather an anti-crisis and anti-inflation solution.

Protection against inflation

Monetary inflation is the number one enemy of savings. While losing value of foreign currencies can erode the value of shares and bonds on the financial markets, therefore prompting an increase in the price of raw materials, the latter have held out particularly well in the face of successive crises, especially gold and palladium.

The impact of the Russian-Ukrainian conflict on commodity markets

Russia and Ukraine play a strategic role on the international commodity markets. Both countries are major exporters of products, such as wheat and grains, oil, natural gas, coal, gold, and other precious metals. The war has affected both domestic production and the crucial distribution chains to the rest of the world, leading to price increases. The situation was described as “catastrophic” by many countries, especially the poorer ones. Experts warn on the consequences of what they call “extreme volatility” on markets, following Russia’s invasion in Ukraine.

The main export products in Ukraine and Russia whose distribution was affected by the war

Energy: There is no capacity in the world to replace the Russian energy production.

Russian economy depends to a large extent on oil and gas export. The country is the third largest oil exporter in the world (after the European Union and Saudi Arabia) and one of the main gas exporters. Russia delivered to the global markets between 7 and 8 million barrels of oil and fuel per day. But today, with the war and with the announcement by the United States, Canada, and the UK on banning Russian energy products, the international oil market is facing the biggest turmoil since 1970. Experts say that prices will continue to rise as long as the war lasts, as there are few alternatives to replace Russian exports.

OPEC (Organization of Petroleum Exporting Countries), of which Russia is not a member, has indicated that such alternatives will not be easy to find.

“There is no capacity in the world that can replace Russian production,” says OPEC secretary general, Mohammad Barkindo. He added that “we have no control over current events, geopolitics, and that is dictating the pace of the market”. Even the countries that import few Russian energy products will feel the impact, as prices for fuel sales to wholesalers will rise.

Food: Russia and Ukraine will go from being a granary to literally having to break bread.

Both Russia and Ukraine are large exporters of food products. The two countries, known as the “breadbasket of Europe”, account for 29% of global wheat exports and 19% of corn exports, according to JP Morgan data. Wheat prices on some futures exchanges have been trading at 14-year highs. Ukraine is the largest global producer of sunflower oil, and Russia ranks second, according to S&P Global Platts. Together, they account for 60% of the global production. Analysts warn that the impact of war on grain production could double international wheat prices. This could seriously affect several countries that depend on grain imports from the Black Sea region. Turkey and Egypt receive almost 70% of their wheat imports from Russia and Ukraine. At the same time, Ukraine is China’s main supplier of corn.

“In Lebanon, around 50% of its grain comes from Ukraine. Yemen, Syria, Tunisia, etc. depend on Ukraine as a grain supplier. Russia and Ukraine will go from being a granary to literally having to break bread. It’s just an incredible reversal of reality,” said World Food Program director David Beasley.

Neon: Ukraine accounts for almost 70% of global exports of purified neon gas.

Ukraine is a leading supplier of purified rare gases such as krypton and neon, the latter essential for semiconductor manufacturing. According to data from consultancy TrendForce, Ukraine accounts for nearly 70% of world exports of purified neon gas, used for lasers that engrave semiconductor patterns.

Over 90% of the neon used by the US chip industry comes from Ukraine. Any change in supply could exacerbate the microchip shortage, which was once a significant problem in 2021.

“As Russia supplies over 40% of the world’s palladium supply, and Ukraine produces 70% of the world’s supply of neon, we can expect the world’s chip shortages to worsen if military conflict persists,” Tim Uy, associated director, wrote in a recent report from Moody’s Analytics.

“During the 2014-15 war in Ukraine, neon prices went up several times, which indicates the severity for the semiconductor industry. Semiconductor companies account for 70% of total neon demand, because neon is an integral part of the lithographic process to make chips”.

Metals: Palladium, gold, silver, and platinum are the only metals that have ISO currency codes.

Russia is one of the most important global suppliers of metals used in anything, from aluminium cans to copper cables and automotive components. The country is the fourth largest global exporter of aluminium and one of the five largest producers of steel, nickel, palladium, and copper. Ukraine is also an important supplier and holds a significant share of palladium and platinum exports. This means that, due to Ukraine’s invasion by Russia, we could witness an increase in the price of copper cans and cables.

“We have seen that aluminium and nickel are up 30% since the beginning of the year, and that will eventually be passed on to consumers when they buy aluminium beverage cans or when they make renovations to their homes, and they will need copper for the cables. All of these prices go into general inflationary pressures,” said Matthew Chamberlain, CEO of London Metal Exchange in London (UK).

Russia remains the third largest gold producer in the world, after Australia and China. In 2021, Russia supplied the world with 350 tons of the precious metal. In early March, gold reached the highest price since August 2020, trading at over USD 2,000 an ounce (one ounce equals roughly 28 grams). This is due to capital inflows from investors seeking safe refuge in times of market uncertainty.

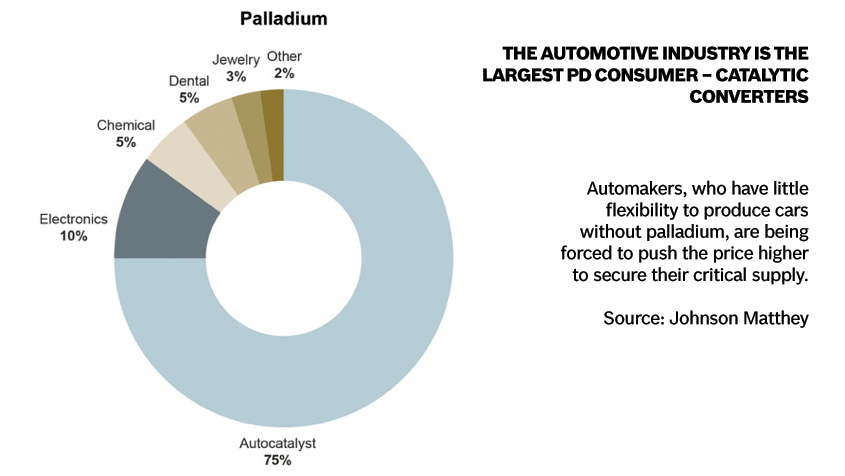

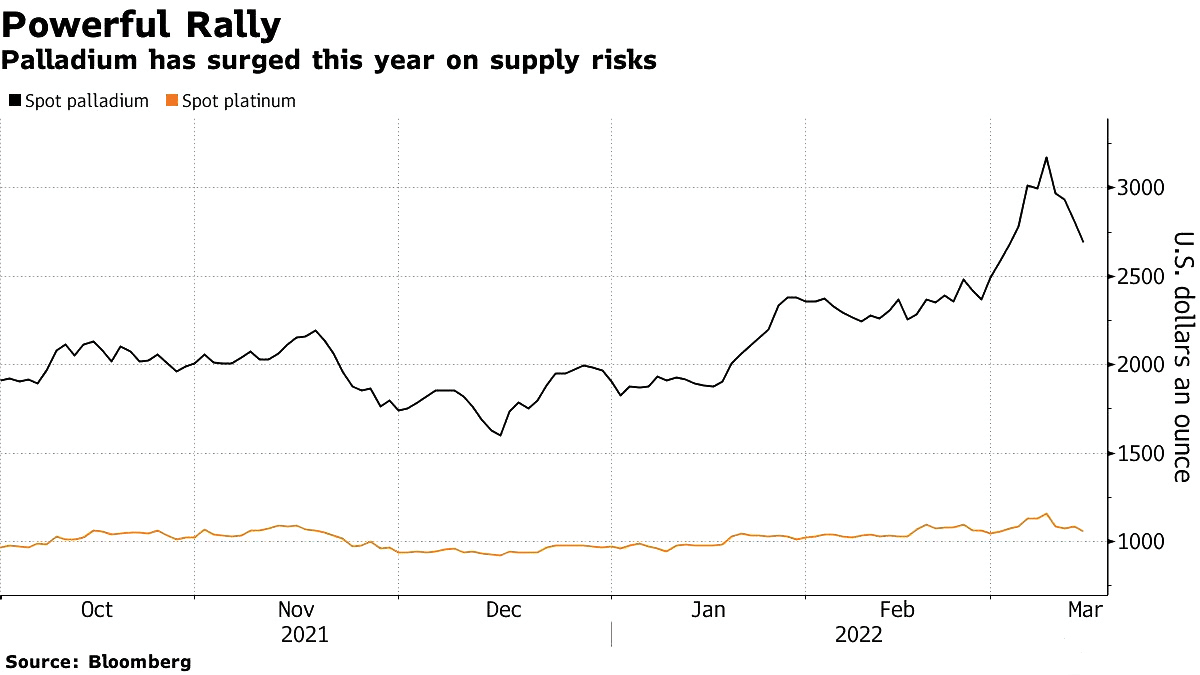

In early March, nickel – used in lithium and iron batteries – rose 76% and palladium – used in catalytic converters in cars to reduce emissions – reached unprecedented levels.

Any disruption of palladium supply, the analysts say, could create serious problems for automotive manufacturers.

“Russia accounts for 38% of global palladium production. Since other regions cannot compensate for supply cuts, the market risks falling into a huge supply shortfall,” according to Commerzbank strategist Daniel Pressman.

Financial markets panic

On March 7, 2022, the record price for this metal cherished by jewellers, palladium, was shattered. In that session, it was traded at USD 3,442 (EUR 3,110) an ounce, before falling slightly back. It therefore exceeded the highest level, reached in May 2021, over USD 3,000 an ounce. A week later, sudden break. Palladium was going back to USD 2,400 an ounce. A difference of almost 30%. On March 18, its price exceeded again USD 2,500 an ounce, therefore meaning an increase by almost 40% compared to the level on January 1, 2022.

With the hope to solve the Russian-Ukrainian conflict, in the context of anticipations on the impact of economic sanctions and concerns related to logistical disruptions, investors reacted quickly, with the risk of causing high volatility.

Palladium is a vital component of pollution control devices for cars and vans. Its use is on the rise as governments, especially the Chinese government, tighten regulations to combat car pollution. Palladium is a silver-white metallic element with atomic number 46 and the symbol for the element Pd. In everyday life, it is most often found in jewellery, dentistry, and catalytic converters for cars.

Palladium has a melting point of 1554oC, a boiling point of 2970oC, a specific gravity of 12.02 (20oC) and a valence of 2, 3 or 4. Palladium has the lowest melting point. Palladium is soft and ductile, but it becomes much stronger and heavier by cold processing. It can be ‘attacked’ by nitric acid and sulfuric acid. At room temperature, the metal can absorb up to 900 times its own volume of hydrogen. Hydrogen diffuses easily through heated palladium, so this method is often used to purify the gas. The finely divided palladium is used as a catalyst for hydrogenation and dehydrogenation reactions. It is also used as an alloying agent, for jewellery making and in dentistry. The metal is also used to make surgical instruments, electrical contacts, musical instruments (transverse flute) and watches.

Palladium is found with other platinum group metals and nickel-copper deposits. The main commercial sources are the Norilsk-Talnakh deposits in Siberia and the nickel-copper deposits of Sudbury Basic in Ontario, Canada. Russia is the leading producer.