New Crisis in the Automotive Market: Magnesium

The scarcity of magnesium threatens the entire automotive market and not only that of electric vehicles. Magnesium is a key metal in the automotive industry, being used to produce different alloys, such as aluminium alloys.

As we have known for several months, the microchip crisis is a threat to the automotive industry. These semiconductors, as they are called, hold a significant part of the industry.

With the Covid-19 pandemic, the stocks of spare parts have dwindled. Therefore, the lack of electronic chips is now delaying the global production. For the automotive industry, the consequences are numerous: Volkswagen was forced to eliminate an ID.3 finish from its catalogue, while Renault was forced to suspend the production of ZOE.

While this deficit seems to continue until 2022, another problem is looming: the shortage of magnesium is threatening the entire automotive market and not only that of electric cars. Magnesium is a key metal for vehicles, as it is used to produce different alloys. Europe did not manage to import from the beginning of September. The supply of this material is almost stopped in the entire European Union. China provides 95% of the magnesium necessary for the European industries. However, the magnesium industry no longer keeps up with demand, especially due to the Covid-19 pandemic. As in the case of semiconductors, large magnesium producers have struggled to reach their targets for 2020. A year later, the stocks are almost depleted, and the industry is crumbling.

Risk to stop production

With the lack of production, prices have skyrocketed, as magnesium is imported today at a price five to seven times higher than at the beginning of the year. The main association of European producers, ACEA, today alerts governments on the dramatic consequences of such situation. According to ACEA, the magnesium deficit could be total by the end of 2021. If so, the association warns that it could cause “production shortages, business closures and associated job losses”. Manufacturers of metals, alloys, packaging, and construction specialists have turned to European governments to find ‘short-term’ solutions.

Factories that move slowly or are even temporarily closed, collapsing turnovers, marketing of new models postponed…

The lack of semiconductors, these essential elements for car electronics, continues to cause pain in the global automotive industry. But the greater evil hasn’t taken place yet, because before this crisis comes to an end a new one could come, that caused by the collapse of magnesium stocks.

This precious metal is not intended only to model a few elements, such as the lightweight wheels of the very exclusive Porsche 911 GT2 RS or Lamborghini Huracán STO. It is used in the composition of aluminium alloys used to manufacture many vital parts of a car: body, transmission, powertrains, engines …

Magnesium is a chemical element with atomic number 12 and symbol Mg, an alkaline-earth metal, the 8th most abundant element in Earth’s crust and the 4th most common element on Earth, after iron, oxygen, and silicon. Mg represents 13% of the planet’s mass and a large part of its mantle, also present in the bones and soft tissues of the human body. It is involved in over 400 biochemical reactions and has a major role in muscle, nerve, and heart.

Appreciated for its properties, magnesium and its alloys are commonly used in the airspace and automotive industries. Good biocompatibility and nontoxicity also find applications in the medical and healthcare fields. Due to its superior electrical and mechanical properties, such as longevity and improved heat transfer, it is also very popular in electronic applications.

Magnesium alloys provide an interesting potential due to their multiple properties: small specific mass (1.7 g/cm3 compared to 2.7 g/cm3 for aluminium), the possibility to produce complex parts (function integration) with thin areas (good fluidity), good impact resistance, good machinability by cutting, higher production rates (20%) than aluminium, good damping capacity, good heat resistance (creep) and, finally, good machinability (cutting power required 1.8 for aluminium compared to 1 for magnesium).

Thixomolding technology

Thixomolding technology was successfully used to produce Mg–5 mass% Zn matrix composites reinforced with nano-SiC. The composites containing 5 mass% of SiC nano-particles were fabricated under pure Ar or Ar+CO2 atmosphere. Microstructure characterization has been carried out by scanning and transmission electron microscopy methods. It was found that regardless of the gas used, the composites consisted of unmelted globular α(Mg) grains surrounded by small areas of a magnesium solid solution formed directly from liquid and a mixture of SiC and MgO. Reaction of CO2 with liquid alloy during process leads to the in-situ formation of MgO nanoparticles, which results in an increase in the amount of oxide particles and refinement of the microstructure compared to the composite produced in pure Ar. These microstructure changes increased the hardness to 70 HV.

Magnesium, as the lightest metallic structural material has great potential to reduce weight and energy consumption in automotive, aerospace, military, and other industries. Magnesium alloys, characterized by excellent castability and machinability, high damping capacity, low elastic modulus and ductility have limited use in engineering applications because of poor creep and abrasion resistance and high corrosion rate. These disadvantages can be overcome by addition of suitable alloying elements and reinforcements to form new magnesium alloys and composites. It was shown that micron-size reinforcements lead to reduction in the ductility due to particle cracking and void formation at particle-matrix interface. Addition of nano-reinforcements (oxides, nitrides, borides, carbon nanotubes, graphene) improves the strength and ductility of magnesium. The nanocomposites have been produced by different methods, but the most often casting processing was used. The most common problem to produce composites is a uniform distribution of the nanoparticles. For this purpose, various techniques were used to disperse the reinforcements, as mechanical stirring, or ultrasonic waves.

Semi-solid metal processing (SSM) seems to be promising technique in nano composites fabrication as the alternative method to conventional casting. It is an advanced technology which uses thixotropic behaviour of alloys or metal matrix composites in the solid state. Thixomolding is a semi-solid route, which involves reheating material to solidus liquidus temperature range and then forming it to near net shape. Additional advantages are the high shearing and mixing in the semi-solid state by the rotation of screw and the transport of suspension through slits, which induce the refinement and homogenous distribution of particles (Microstructure of Mg–Zn Matrix Composite Reinforced with Nano-SiC Prepared by Thixomolding/Łukasz Rogal, Piotr Bobrowski, Katarzyna Stan-Głowińska, Maciej Szlezynger, Lidia Lityńska-Dobrzyńska).

Magnesium alloys

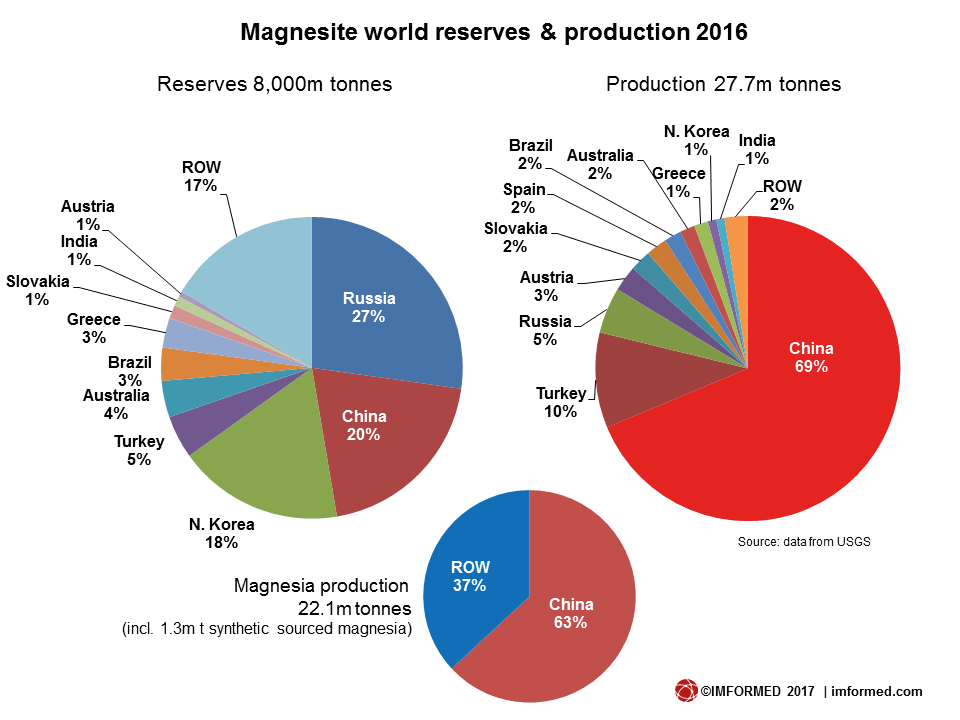

We need to distinguish the standard alloys used in die casting (AZ91HP, AM50 and AM60) for the automotive market from other state-of-the-art alloys (AE42, AM20, AS21, AS41…, AZ80) doped with zirconium and rare earths to improve them (characteristics for the aeronautical market). Magnesium mineral resources are relatively important and well distributed. Its use is constantly growing, and it should be noted that die casting of magnesium alloy constitutes only about a third (300,000 t/year) of its use. Magnesium is in fact used extensively as an alloying element for aluminium (AlSiMg0.3, AlMg3Ti…), for inoculating cast iron, desulfurizing steel or refining titanium. The tonnages of magnesium in die-casting worldwide are still very modest (300,000 t/year) compared to those in die-casting aluminium (approximately 6,000,000 t/year), even if they are on the rise.

Applications in the automotive, aeronautical and electronics industries

So far, magnesium applications are in the automotive industry, military aeronautics (including helicopters), in AVIT – Audio-Video-Information-Technology – (camera case, gamepad or smartphone case) and leisure (cycling, portable instruments). The auto parts that have been the subject of magnesium applications are the steering column bracket, steering wheel frame, cylinder head cover, gearbox body (AZ91D), instrument panel, control panel, door and seat structure, intake housings and manifolds, wheels (AZ91D, AM60B) and, in general, various parts inside the passenger compartment. Only the AM50 magnesium flywheel frame has become essential as a replacement for the aluminium overlay of a steel tube insert. North American manufacturers (Ford, GM) are big users of magnesium in their models.

Obstacles to a more widespread use of magnesium

In addition to the Chinese policy of diminishing production, securing supply and the fluctuating costs of materials are, without any doubt, other major obstacles, as they make it difficult to decide to launch magnesium projects that will cover 10 years for a new generation of vehicles. The low global tonnage and the decision of a producer for example to increase the use of magnesium can also stimulate demand and bring the price of the metal, which in the past (2005) has already fluctuated sharply, from 2,000 USD/t to 6,000 USD/t in three years.

The recyclability of magnesium alloys is also a barrier. Indeed, recycling is more complex (protection, cleaning, risk to lose the mechanical characteristics etc.) than that of aluminium alloys and is hardly practiced domestically by producers who return their waste to refineries, which generates additional costs.

In the end, the strong tendency of magnesium parts to oxidate requires anodic protection, engraving and painting to protect them. Moreover, the phenomena of galvanic corrosion during the assembly of magnesium parts with other metals (steel sheet, aluminium, etc.) require the existence of specific solutions (insulating coating, smooth screws to avoid drilling etc.).

Chinese quasi-monopoly

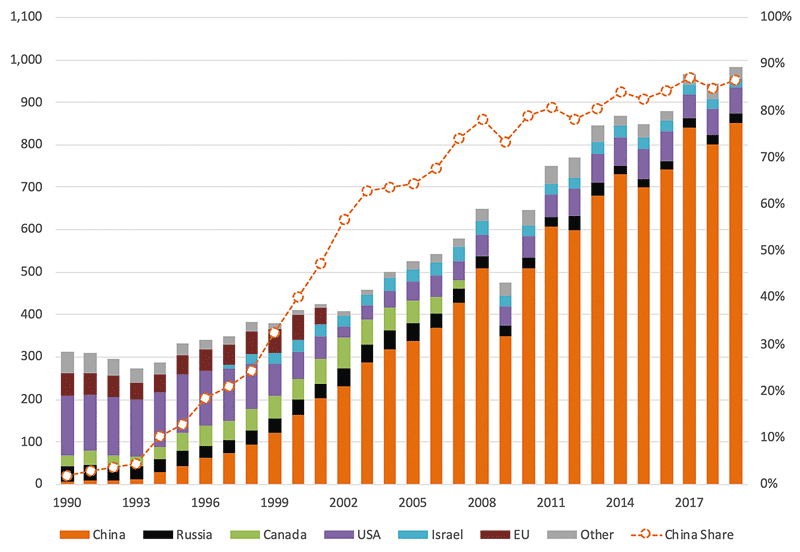

As in the case of semiconductors, this crisis also takes place in China. According to an article from the international media, 85% of the global magnesium production is ensured by China, the same share coming mainly from a single city, Yulin. The problem is that the local authorities have issued an order to almost 50 foundries to cease any activity until the end of the year, to fulfil the objectives of reducing energy consumption.

For several months, the country has been affected by serious electricity supply problems. Magnesium production would consume three times more energy than aluminium and, still, there is no real substitute for this metal and its storage can only be for a short-term due to relatively quick oxidation. Therefore, the reserves of different countries could disappear in a short period of time.

While the United States seem almost immune to a shortage due to local production, Europe is exposed to a greater risk if the threat of supply disruption materializes. Once again, there is a dependence of an industry on one and the same country, China being a major provider of rare metals, met especially in batteries and cars.

Although magnesium is apparently ubiquitous (it is also the 3rd most abundant element dissolved in seawater, after sodium and chlorine), its atoms exist in nature only in the form of combinations with other elements. The pure element is produced artificially through an oxidation-reduction reaction or electrolysis, which allows chemical reactions to be performed by electrical activation.

But, as with many other productions, Asia, and especially China, holds the keys to magnesium, and Europe buys 95% from China. In 2018 China produced 85% of global magnesium, Kazakhstan, Israel, and Brazil being the next largest producers of magnesium in the world.

Very dependent on supply from China (almost 860,000 tons in 2020 according to STATISTA), the global market has therefore suffered due to a sudden decline of the Chinese production, affected by the energy deficit and the country’s objectives of reducing the carbon emissions. Indeed, the magnesium production is energy-intensive and produces significant carbon emissions. According to some estimates, it takes 35 to 40 MWh of electricity to produce one tone of magnesium. To reduce the electricity consumption in the context of the current energy shortage, the Chinese authorities have recently called for a halt to the production of many magnesium producers in Yulin, in Shaanxi Province (northwest China), the country’s main magnesium production base. While most companies have resumed operations since the beginning of October, they were asked to operate at approximately 40% of their normal capacity.

China: future restrictions in sight

As China is heading to a more energy efficient economy, we can expect soon specific restrictions imposed on the production of many energy-intensive industries. Due to reduced supply, the price of magnesium climbed to all-time highs, almost USD 10,000 per ton, compared to around USD 2,700 in mid-August.

The investment market, about which it is expected to register an annual growth rate of 7.5% between 2020 and 2025, is also set to grow the magnesium industry.

China is obviously essential with the 27 magnesite deposits, and Shanxi Yinguang Magnesium Industry is the group in Shanxi Province that owns almost 60% of the country’s magnesium production.

But in sight are also the groups that could benefit from the boom in the Mg market: Australia’s Latrobe Magnesium, Magontec and Korab Resources, as well as Canada’s Karnalyte Resources, Western Magnesium and MGX Minerals.

Risk of Europe-wide shutdowns due to Chinese magnesium supply shortage

Considering an imminent international supply shortage of magnesium originating from China, European Aluminium calls on the EU Commission and national governments to urgently work towards immediate actions with their Chinese counterparties.

With an 87% production share, China has a near-total monopoly on global magnesium manufacturing.

In 2001, Europe was forced to close its remaining magnesium production as a consequence of dumped Chinese imports, and now depends for 95% on China’s supply.

Europe is expected to run out of magnesium stocks in 1- or 2-months’ time (Call on EU policymakers to address imminent supply shortage of Chinese magnesium/Position paper, 27 September 2021). A supply shortage of the current magnitude risks production stoppages in the aluminium value chain, affecting sectors such as automotive, building or packaging. Other magnesium-using sectors are diecasting, and iron and steel production.

The current magnesium supply shortage is a clear example of the risk the EU is taking by making its domestic economy dependent on Chinese imports. The EU’s industrial metals strategy must be strengthened – aluminium cannot become the next industry leakage case.

Romania recycles magnesium waste

In Sântana, Arad County, a factory has been operating for almost a decade to obtain magnesium ingots, bars, and alloys from magnesium waste through the smelting process. The factory is a subsidiary of Magnotec, European leader in magnesium recycling, with an old tradition and reference technological know-how and has a capacity of 7,000 tons per year.